- Print

- DarkLight

- PDF

Reimbursement - Gross Up

- Print

- DarkLight

- PDF

A “gross up” provision in a lease relates only to Operating Expenses that vary with occupancy (i.e. “variable” expenses), such as utilities and cleaning services. When a building has relatively low occupancy, those expenses will sometimes be “grossed up”, or increased to reflect full or high occupancy for reimbursement purposes.

For example - imagine a building has ten floors, each of 10,000 square feet, and ten tenants, each occupying one floor, for a total occupancy of 100%. Each tenant is to pay its pro rata share, i.e. 10%, of operating expenses. If cleaning expenses cost $1,000 per floor - the building, as fully occupied, would incur $10,000 in total cleaning fees, and each tenant would pay their fair share (i.e. $1,000) toward that sum - in other words, each tenant would pay for and receive $1,000 worth of cleaning services.

If, in this example, the occupancy were to fall from 100% to 50% - cleaning services would only be needed on five of the floors, and the resulting expense would fall to $5,000. Without a gross up provision, each of the five remaining tenants would still pay 10%, or in this case, $500, toward the total expense - resulting in a shortfall of $2,500 to be paid by the landlord. “Grossing up” that cleaning expense to $10,000 for reimbursement purposes results in, again, each of the five tenants paying for and receiving $1,000 worth of cleaning services.

Gross Up in CashFlow:

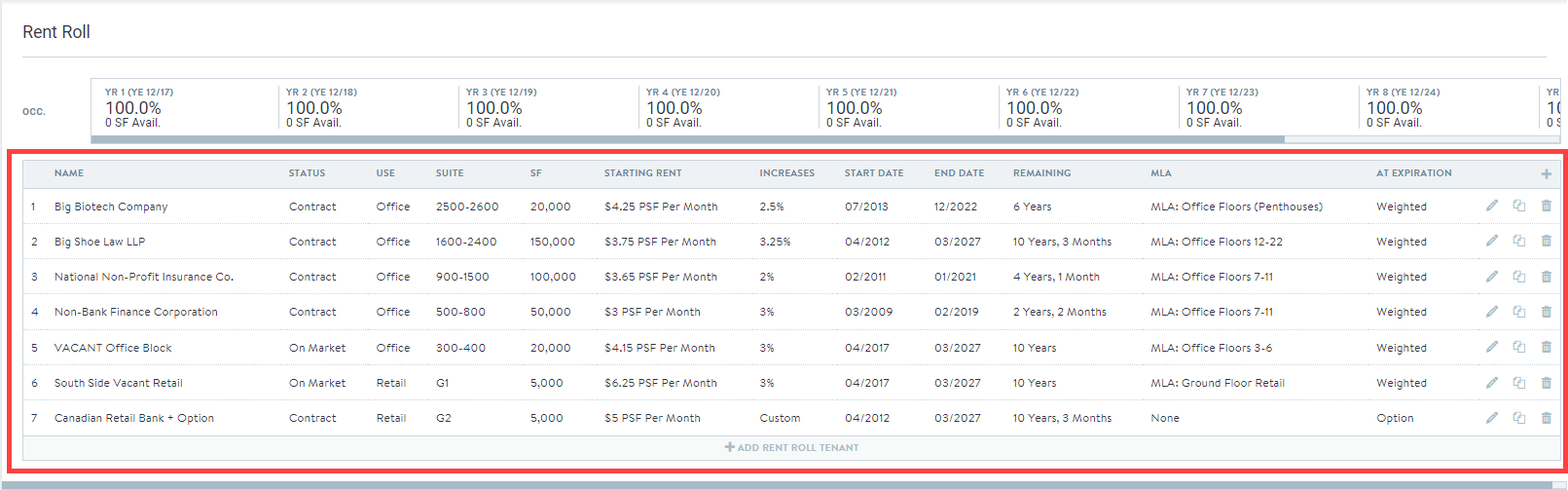

| Click Rent Roll in the left navigation bar. | .png) |

| Select an existing entry from the table. |  |

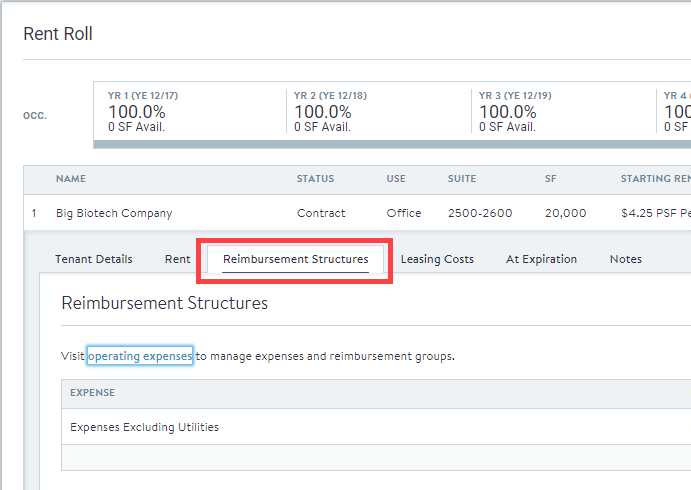

| Click the Reimbursement Structures tab. |  |

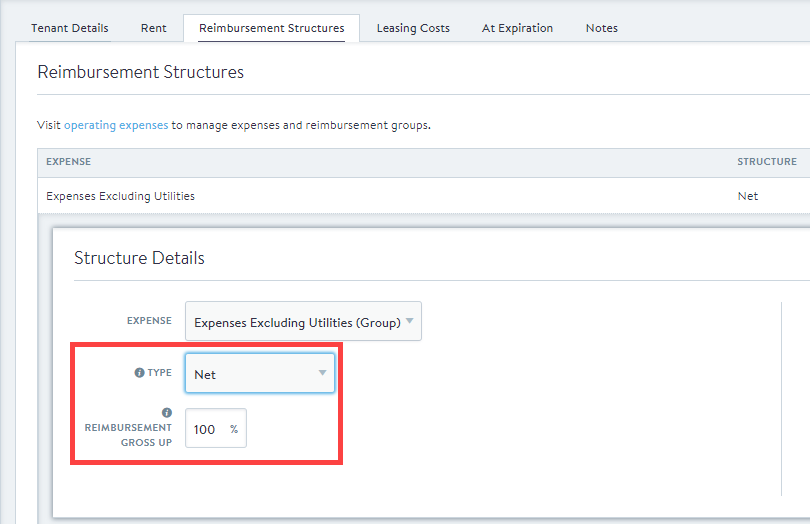

Click an existing Reimbursement Structures entry. NOTE: This process is intended for the Structure Type Net only. If Type is not set to Net, the Reimbursement Gross Up field will not be exposed. Enter a value in the Reimbursement Gross Up field. |  |

.png)

.png)