- Print

- DarkLight

- PDF

Loan Sizing

- Print

- DarkLight

- PDF

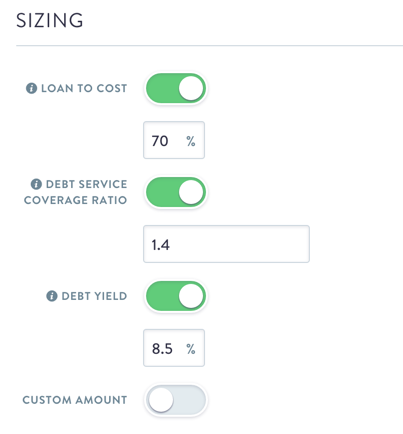

In order to determine a loan amount for a property, one can set several "constraints" (such as loan to cost or debt service coverage ratio), and the lowest resulting value is what will be used by the model. For example, say a bank refuses to make a loan in excess of 70% loan to cost, or below an 8% debt yield. If a property were worth $1,000,000 and produced $50,000 of net operating income NOI - the 70% loan to cost constraint would result in a maximum loan balance of $700,000, and then 8% debt yield constraint would result in a maximum loan balance of $625,000. So, in order to make sure that all constraints are met - CashFlow uses the lowest resulting loan balance from all of the user-inputted constraints. In this case, $625,000.

CashFlow utilizes the most common loan sizing methods in the industry, automatically inputting the lowest resulting value into the model.

.png)

.png)