- Print

- DarkLight

- PDF

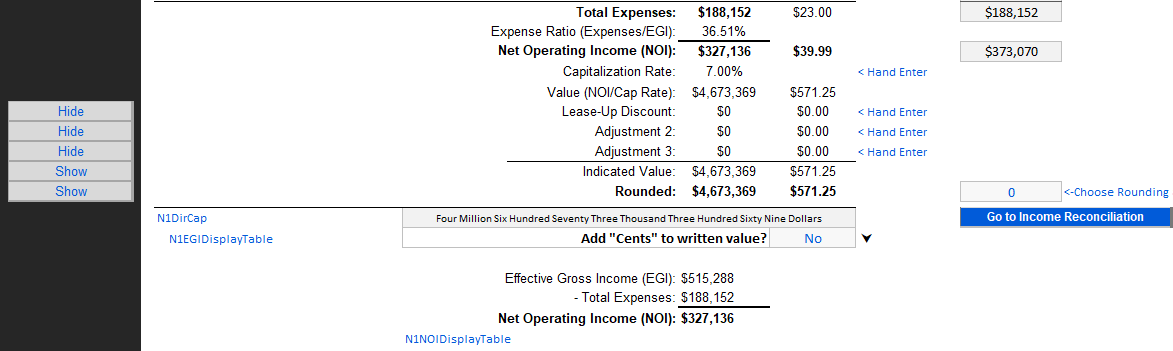

Direct Capitalization - Expense Analysis

- Print

- DarkLight

- PDF

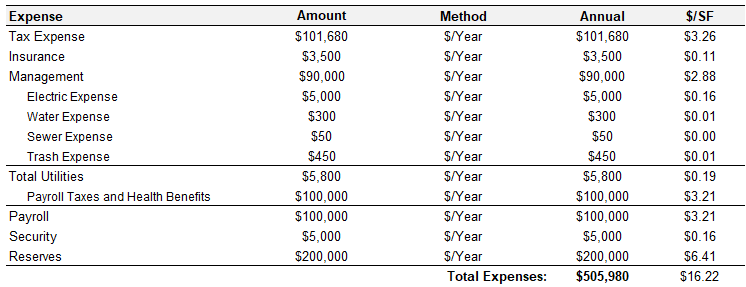

The Expenses table shares similarities with the Income Analysis in regards to how you will input data; work from left to right, ensuring that Toggle Display is enabled so that you may enter new entries. Toggle Display is located to the left of the Income Analysis table.

Using the Expenses Table

| 1. Expenses When you enable Toggle Display, the expense categories that appear correspond with the expense categories in the database. |

| |

| 2. Enter the Total Expense Amount, Not Including Reimbursements The Expense Amount should be entered as appropriate. Note whether it is a rate that is incurred yearly, by square footage, or some other special factor. |

| |

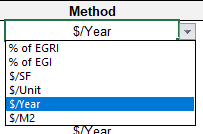

| 3. Select How the Expense is Incurred If the Amount that you entered is a yearly rate, simply click into the Method drop-down and select $/Year. Otherwise, select the option from the drop-down that matches the format of the Amount you entered. |  | |

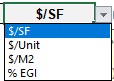

| 4. Select how the Data is Broken Out The last column has a configurable header, and clicking on the column cell will produce a list of four options that can be used to further break down your expenses. |  | |

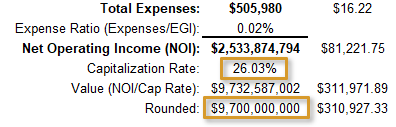

| 4a. The Net Operating Income (NOI) is calculated automatically. The capitalization rate is entered by the analyst, as is the final and the final rounded value. Final cap rates, and values should always be reviewed to ensure appraiser judgment in the valuation process. |  | |

| 4b. There may be scenarios where items like lease-up discounts may need to be entered below the NOI line. Hand enter the label and the amount and verify that the totals are correct in the final rounded value. |  |

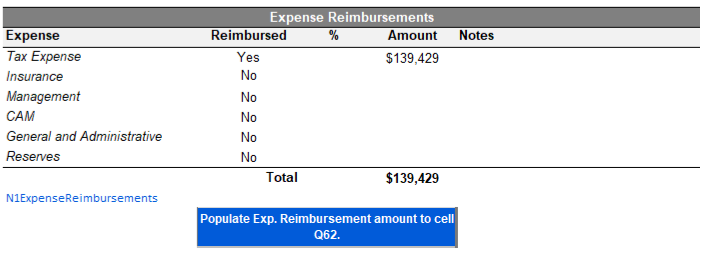

Expense Reimbursements

You can account for any reimbursements via the Expense Reimbursements table that is situated adjacent from the Expenses table. You will find each of your expenses listed on the Reimbursement table; simply select whether a certain expense is reimbursed or not via the Reimbursed drop-downs, and enter any desired notes into the Notes column.

| Note: Add expense reimbursements above PGI by clicking the Populate Exp. Reimbursement amount button. |

.png)

.png)