- Print

- DarkLight

- PDF

Debt Service Coverage Ratio (DSCR)

- Print

- DarkLight

- PDF

The ratio between a property's net operating income ("NOI") and its annual debt service. DSCR is often used as an underwriting constraint for commercial real estate loans.

The formula is: DSCR = NOI / Annual Debt Service. For example, a property generates $20,000 of gross rent and requires $5,000 of operating expenses per year, resulting in an NOI of $15,000. If the annual debt service for the property's mortgage is $10,000, the property's DSCR is $15,000 / $10,000 or 1.5. So, if a bank weren't willing to make a loan with a DSCR below 1.5, the largest loan they'd be willing to make would call for annual debt service in the amount of $10,000.

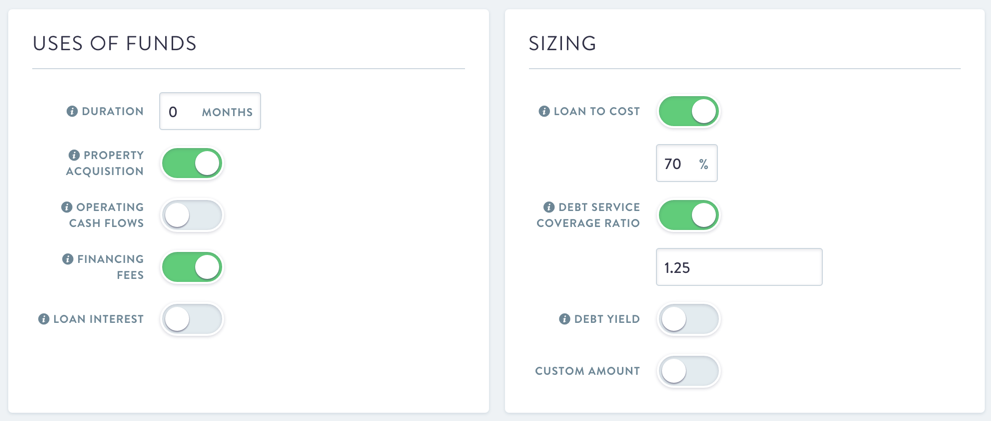

DSCR is one of several loan constraints available within CashFlow; all of them can be checked at the same time, and the prevailing loan amount, which will be factored into the model, will be the most conservative of the four.

.png)

.png)