- Print

- DarkLight

- PDF

Cost

- Print

- DarkLight

- PDF

The Cost Worksheet is formatted to work with the Marshall Valuation Service. However, you do not need to rely on Marshall Valuation cost calculations and can adapt the tables below to suit your needs.

Cost and depreciation calculations are broken into the following sections:

- Cost Source

- Building and Site Improvements

- Soft Costs

- Total Costs

- Depreciation

- Land Value

There are three total Cost sections dedicated to cost calculations; all three sections are identical, and the information below applies to each section.

Marshall Valuation Service - Cost Source

The initial section can be used to indicate if information from Marshall Valuation Service is being used in the appraisal. Enter 1 for each Multiplier if it is not being used.

If you do not wish to use Marshall Valuation cost calculations, you can click the Cost Source cell and select from a new drop-down entry. You can use the List function to change the existing options in the list; this action removes the Marshall Valuation Service title from the table row header.

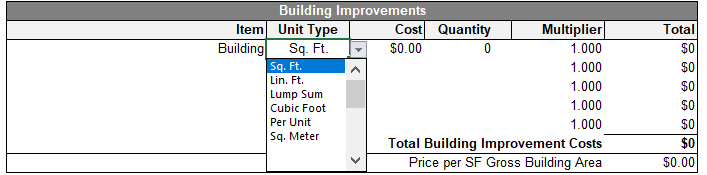

Building and Site Improvements

In the first column, enter a Building Cost Component. Next select or manually enter the Unit Type for the cost component (Sq. Ft., Lump Sum, etc.) from the drop-down field. Finally, enter a Cost and Quantity for the item. Report Writer will then calculate the component cost.

To add more Items, click the Toggle Display button located to the right of the table. Click Toggle Display again when you have finished adding items.

Site Improvement calculation follows the same procedure as Building Improvements.

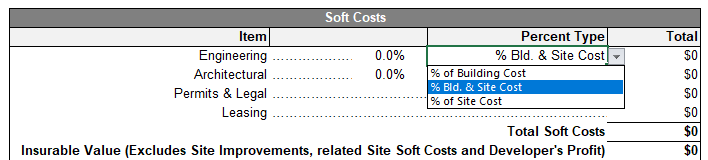

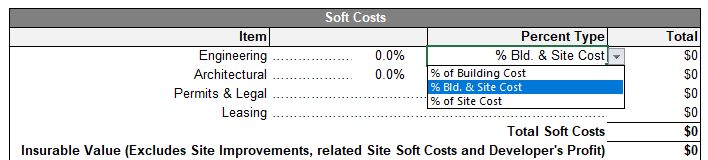

Soft Costs

The initial Soft Cost categories (Engineering, Architectural, Permit & Legal, Leasing) are all modifiable; click into a cell and change the contents to match your needs.

The Percent Type cells adjacent from the first two Soft Costs are drop-downs, where you may choose between the pre-defined options, manually enter your own, or leverage the List Manager to change them outright.

Total Costs

This section combines the building and site costs with a line for Developer's Profit, which can be re-labeled as Entrepreneurial Profit, Builder's Profit, etc., via the drop-down menu or manual entry efforts.

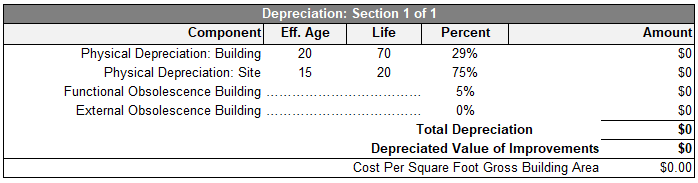

Depreciation

Calculations will automatically allocate the building and site costs for physical depreciation. The Report Writer uses a basic physical age-life method to estimate physical depreciation; enter the Effective Age and Physical Life of the component. Functional and External Obsolescence must be manually entered and are calculated based on building improvement costs. This excludes site costs, but includes profit.

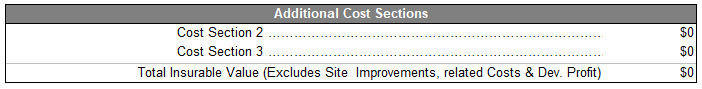

Additional Cost Sections

The totals for the 2nd and 3rd cost sections will be populated from the corresponding sections as needed.

The 2nd and 3rd sections are optional and will not automatically populate in your appraisal report once you merge. Use the insert Fields and Tables function to import those sections.

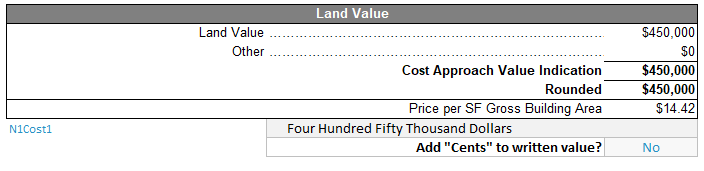

Land Value

This section is for the Land Value and associated land value items that may warrant inclusion. You can edit the Land Value and Other cells to help customize the table to suit your needs and edit the actual value amounts.

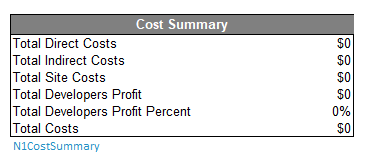

Cost Summary

The Cost Summary Table Summarizes the Cost attributes from the three Cost Sections.

.png)

.png)