- Print

- DarkLight

- PDF

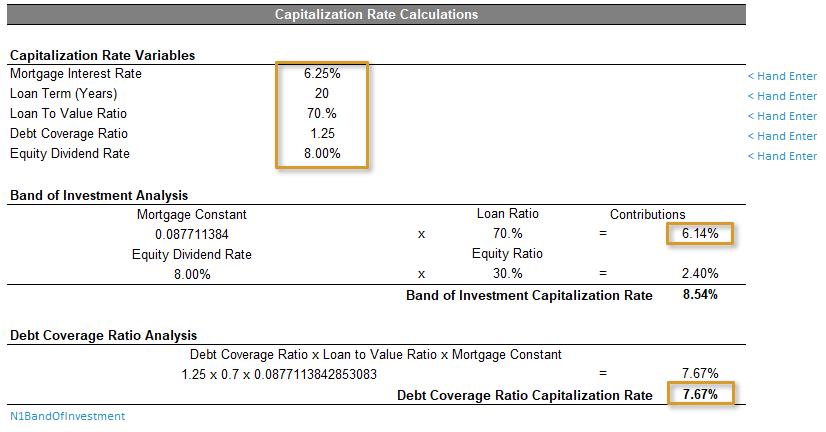

Capitalization Rate Calculations

- Print

- DarkLight

- PDF

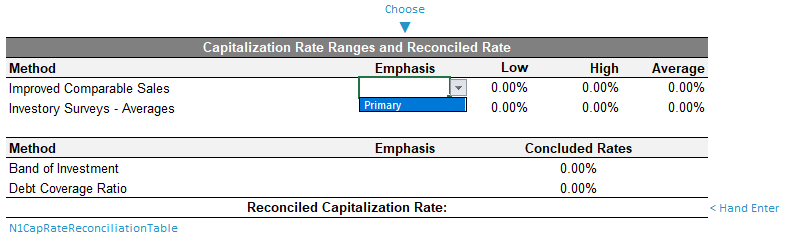

There are three tables that pertain to the calculation of capitalization rates, which describes the relationship between net operating income and sale price.

Variable, Band of Investment and Debt Coverage

The Capitalization Rate Variables are all manual entry fields, and upon entering in each respective value, you will find that Band of Investment (BOI) and Debt Coverage Ratio (DCR) Capitalization Rates automatically calculated.

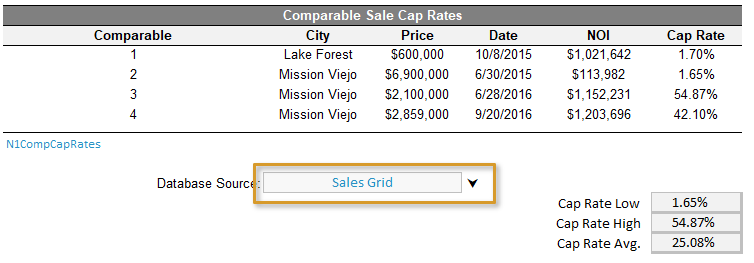

Cap Rate Comparables

Each of your comparables featured within the Sales Grid will be represented in the Comparable Sale Cap Rates table. The Min, Max, and Average Cap Rate values can be found in the lower right-hand corner of the table.

If you have multiple Sales Grids with their own unique comp entries, you can select which grid you wish to use to populate this table via the Database Source drop-down.

You can also manually hand-enter this data; unprotect the worksheet and write your values into the cells.

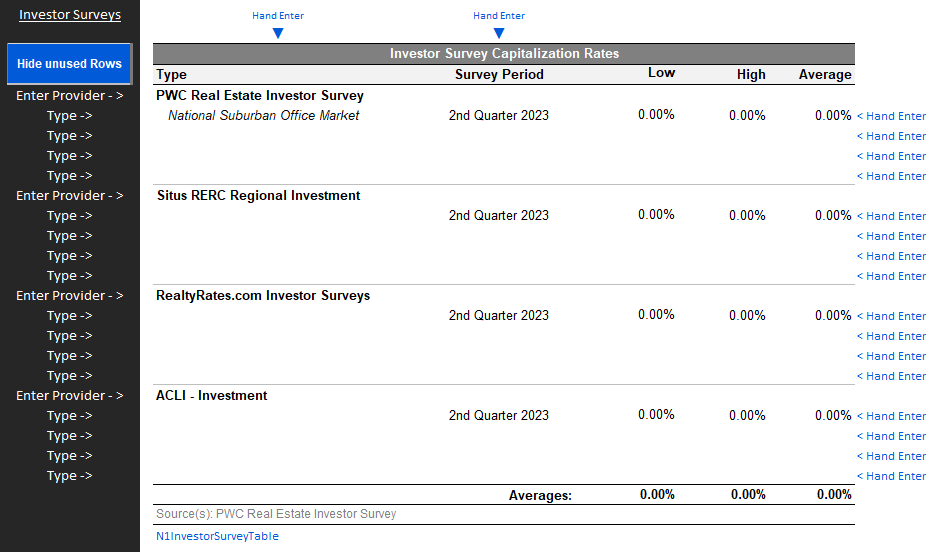

Investor Surveys

The Investor Survey table allows for multiple metrics for up to four providers of Investor Surveys. Hide any unused rows by clicking the Hide Unused Rows button to the left of the table.

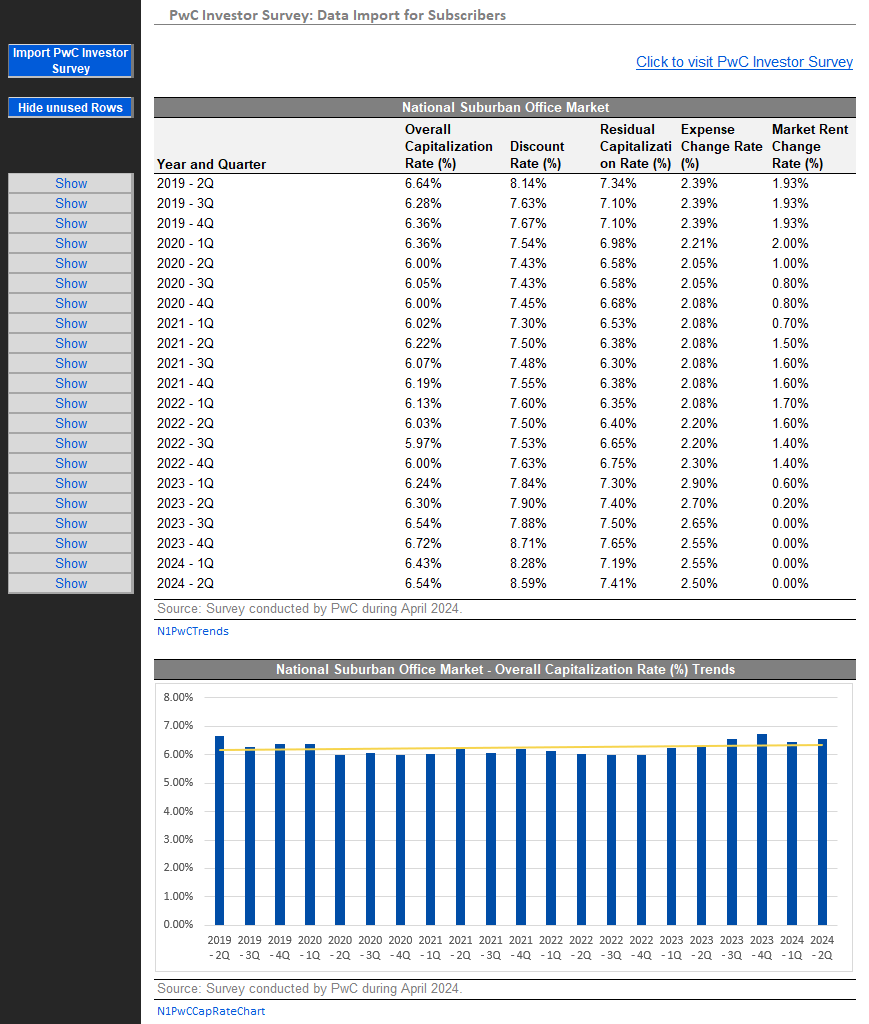

PwC Investor Surveys Import

For users with subscriptions to PwC Investor Surveys, navigate to the PwC Investor Surveys Website, download the data to an Output.xlsx file and click the Import PwC Investor Survey button.

Unused rows will automatically hide, but you may choose to hide additional rows, and click the Show/Hide Unused Rows button to your liking. Link the most recent Quarter and the Average Cap Rate to the Investor Survey Table above.

A Trend chart for Cap Rate and Discount Rate have also been provided to assist in the visualization of trends for your market/property type.

Capitalization Rate Reconciliation

Once the Cap Rate has been determined, click the Populate Concluded Cap Rate in Direct Capitalization table button to apply your concluded cap rate to the Pro Forma.

.png)

.png)