- Print

- DarkLight

- PDF

Capitalization Rate

- Print

- DarkLight

- PDF

Also called Cap Rate. The unlevered return that a property produces upon purchase without taking into account any non-recurring expenses. For example, if a property is expected to produce $10 of NOI, and was purchased for $100 - the property was purchased at a 10% cap (capitalization) rate. A lower cap rate on the same NOI equates to a higher property value. If that same $10 of NOI were now valued at a 5% capitalization rate, the property's value would then be $200.

The formula for Cap Rate is: Value = NOI / Capitalization Rate. (Of course, that formula can be manipulated algebraically depending on what information you have. I.e. NOI = Value x Capitalization Rate, or Capitalization Rate = NOI / Value)

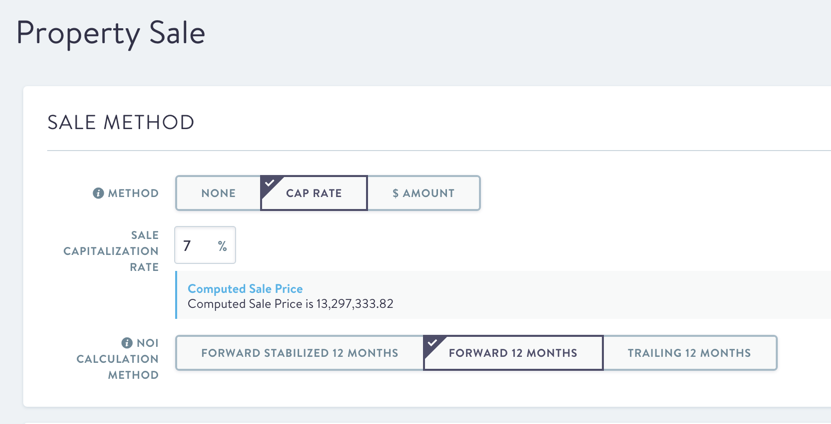

Typically, commercial real estate is traded based on how that property is expected to perform in the 12 months following the acquisition or sale. The cap rate for that "forward 12 months" of NOI can have a major effect on the projected returns for an investment. Within CashFlow, that capitalization rate is inputted on the Property Sale tab.

.png)

.png)