- Print

- DarkLight

- PDF

Capital Expenditures

- Print

- DarkLight

- PDF

An amount spent on an improvement that provides a long-term benefit. Capital expenditures are generally depreciated over their useful life, and are considered "below the line" expenses in that they are not reflected in a property's NOI (net operating income).

In commercial real estate, a capital expenditure can be anything from parking lot repaving, to roof replacement, to ground-up construction of a new building - really anything that calls for a one-time expense at a property.

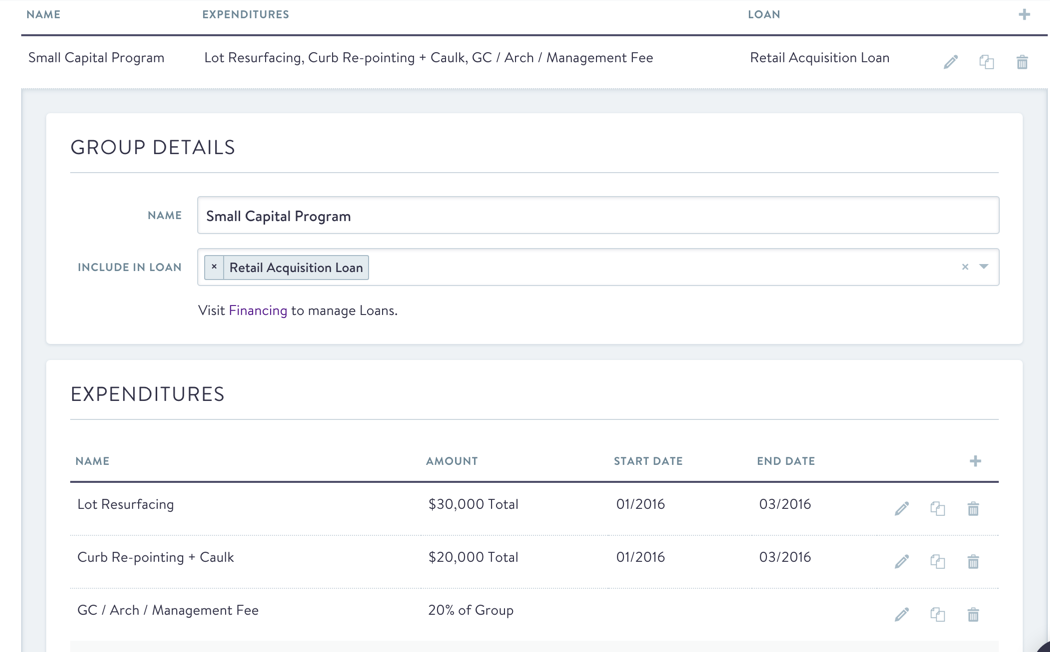

Within CashFlow, capital expenses can be added in groups, and individual expenses can be assigned their own start and end dates. The expenses will automatically be divided evenly amongst the months during which the expenditure is set to take place.

.png)

.png)