- Print

- DarkLight

- PDF

"At Expiration" Options

- Print

- DarkLight

- PDF

Though not particularly complicated in theory, handling “at expiration” scenarios in commercial real estate investment analysis without a tool like CashFlow can be complicated and time consuming - especially for properties with more than a few tenants.

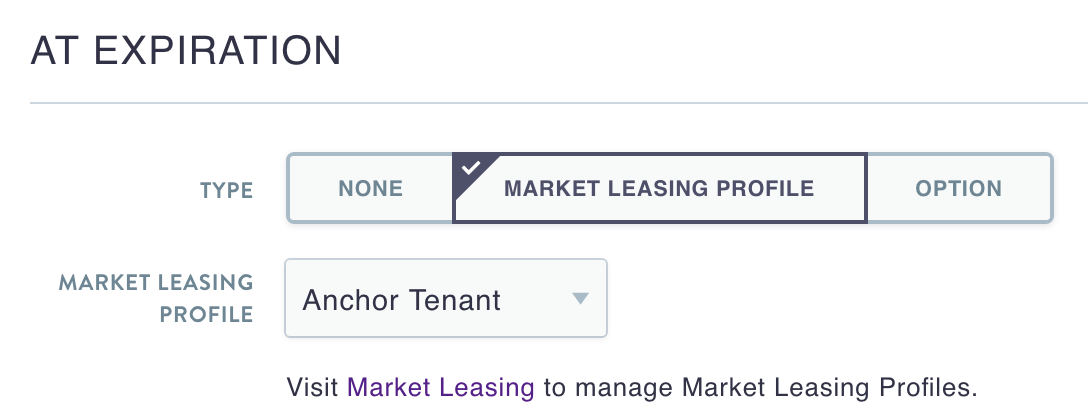

In order to create a valid Rent Roll tenant, you must choose one of three options for the “At Expiration” value:

None: Upon the expiration of that lease, the space will be counted as vacant and remain vacant for the remainder of the analysis.

Market Leasing Profile: Likely to be the most commonly used of the three, this defaults the newly vacant space to a prior-defined market leasing assumption ("MLA") profile that outlines the details of the space’s lease-up, including downtime between leases, tenant improvement and leasing commissions expenses, market rents, etc.

Option: Though primarily intended for tenants with contractual options in their lease agreements, this designation can also be used as a custom entry type to handle an expiring lease if you believe that none of your existing MLA profiles is a good fit. This is useful for “one-off” situations, like a short-term renewal, special rental rate schedule, or a special TI/LC structure.

.png)

.png)