- Print

- DarkLight

- PDF

Amortizing Loan

- Print

- DarkLight

- PDF

In real estate, an amortizing loan is typically a fixed-payment loan in which a portion of each month's payment goes toward interest on that month's outstanding loan balance, and the remainder goes toward reducing that balance. As the principal gets paid down, a smaller portion of each month's payment goes toward interest, and consequently, a larger portion goes toward paying the loan down.

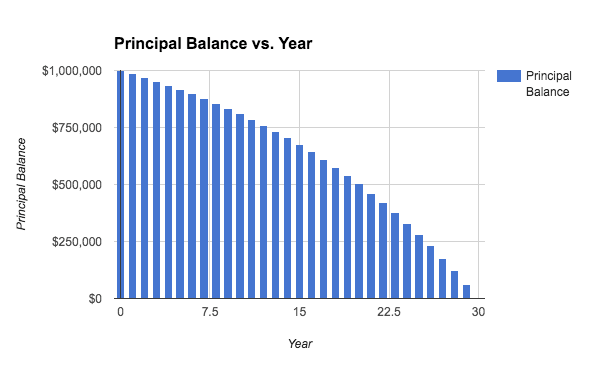

Pictured above: The annual outstanding principal balance of a $1MM, fixed-rate, fixed-payment loan that amortizes over 30 years. Note how the loan gets paid off quicker toward the end of the amortization schedule.

A commercial real estate loan typically amortizes over a 20-30 year term, but most won't stay outstanding that long. The loans will most commonly have 5-10 year terms and will "balloon" at maturity, meaning that the entirety of the then outstanding principal balance will be due at that time.

Within CashFlow, a user can specify certain loan constraints, as well as an amortization period, and the corresponding loan will be factored into your model. All assumptions can be accessed via the Financing tab.

.png)

.png)

.png)