- Print

- DarkLight

- PDF

Introduction to RIMS

- Print

- DarkLight

- PDF

The Purpose of RIMS

The RIMS platform provides lending institutions with several important benefits:

- Regulatory Compliance: The RIMS platform separates lending and appraisal functions, as required by regulations. It provides a full audit trail, robust and intuitive reporting, and automatic logging of all documents and communication.

- Record Management: All records related to the commercial lending process, including Service Requests, RFPs, Vendor bidding, Appraisal Reports, and Invoices are stored for easy access during the appraisal process and afterward.

- Communication Centralization: Communication between the Commercial Lending Department, Appraisal Procurement Department, and third-party Vendors is centralized and streamlined. All relevant parties are provided with an intuitive means of communication at every step in the process. All messages are logged, and communication barriers between the Commercial Lending Department and Vendors satisfy 'arms-length' regulatory requirements.

- Efficiency: The RIMS platform was designed and developed by commercial lending and appraisal professionals to meet the actual, day-to-day requirements of those positions. Centralization of all related functions under a single, intuitive UI reduces staff training requirements and turnaround time on appraisals.

There are two separate, but interconnected RIMS sites:

RIMS (sometimes referred to as RIMS Core): RIMS is where the vast majority of RIMS work will be conducted. It is where employees in the Loan Origination Department and the Appraisal Procurement Department will spend all of their time.

RIMSCentral: Appraisers will use RIMSCentral to bid on RFPs and upload their completed Reports and Invoices.

The Function of RIMS

RIMS provides the means for the loan origination group to order Appraisals and services from real estate professionals efficiently while maintaining the appraisal independence required by Federal regulation.

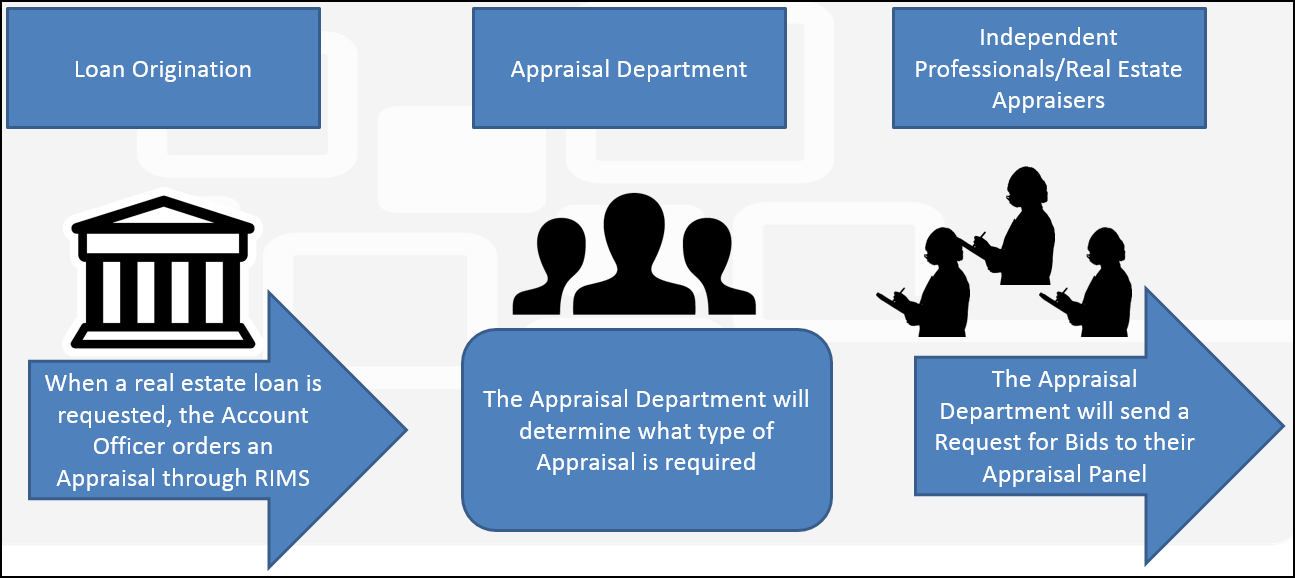

The process begins with the Loan Origination Department. In RIMS, users from the Loan Origination Department are referred to as Account Officers. The Account Officer creates a Service Request and submits it to the Appraisal Department. A user in the Appraisal Department, referred to as a Job Manager, will then decide what type of Appraisal is required. They will create a Request for Proposal and submit it to select Appraisers (referred to as Vendors) on RIMSCentral for bidding.

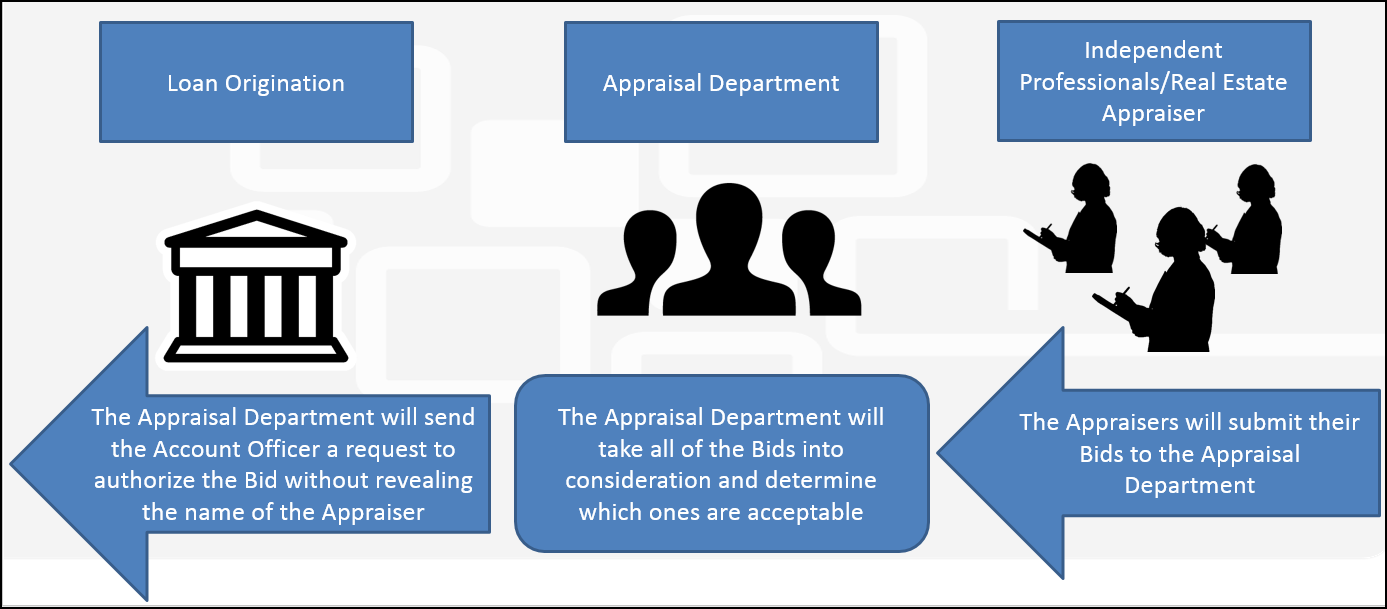

The Vendors will submit their Bids to the Appraisal Department through RIMSCentral. The Job Managers will then submit the acceptable Bids to the Appraisal Department for review. The RIMS platform will automatically hide the Vendors' names from the Account Officers.

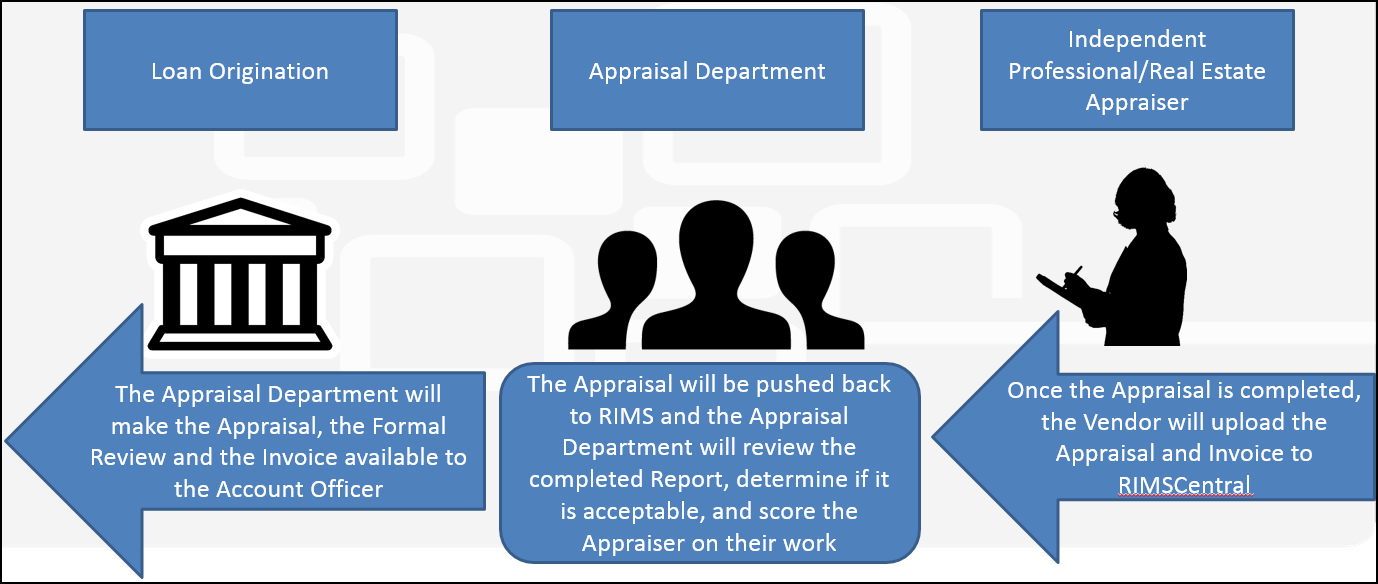

The Vendor completes the Appraisal and Invoice and uploads both in RIMSCentral, which sends them to the Job Manager in RIMS. The Job Manager will review the Appraisal. If the Appraisal is unacceptable, the Job Manager will notify the Vendor of any deficiencies. Once a complete, acceptable Appraisal has been received, the Job Manager forwards it to the Account Officer.

The Job Manager then completes a Vendor Scorecard, grading the Vendor on the quality and timeliness of their work. The Job Manager will also send the Invoice to the Accounting Department.

Additional Resources

To learn more about RIMS, please refer to the following documentation and videos:

- Service Requests: These pages describe the process Account Officers use to request an Appraisal or Environmental Report.

- RFP Creation and Management: This section describes the process Job Managers use to evaluate the requirements of a Service Request, then create and publish a Request for Proposal.

- Project Console: The majority of Job Managers' work is done in the Project Console. This documentation will familiarize the user with the features and functionality of the Project Console.

.png)