- Print

- DarkLight

- PDF

Parcel Boundaries FAQ

- Print

- DarkLight

- PDF

Q: Why are some parcels lacking property attribution?

A: Parcel boundaries are often maintained and provided by a separate entity than property attribution. Parcels are frequently maintained by an entity, such as the county GIS, survey, or public works team while the attributes are maintained by the county assessor. These two entities generally release their content at different times.

LightBox obtains parcel boundaries and assessor attribution as quickly as possible and then joins the parcel boundaries to the tax attribution. While the LightBox team is the gold standard in the industry for this process, linking may not be perfect in these scenarios:

- Different data vintages. For example, if parcel boundaries are newer than the assessor attribution. In this scenario, parcel boundaries may exist that have not yet appeared int he assessor data. These parcels have no assessor attribution to link to.

- Parcel data is missing information to link to attribution. We leverage parcel attribution such as parcel identification numbers to link to the property information. These values are not always present. There are also scenarios where parcels are digitized from a physical source and therefore have no attribution to leverage for linking to assessor attribution.

More information:

Q: Are parcels edge matched?

A: It is possible that in some circumstances parcel overlaps or gaps may exist. The parcel boundaries that you receive are provided by each county. Since each county is the subject matter expert within each of their respective jurisdictions, we rely on them for the alignment of the parcels. Enforcement of topology rules to permit or prohibit slivers, gaps, etc. are determined by each county.

Q: What is the difference between "Stacked" and "Flat" parcels?

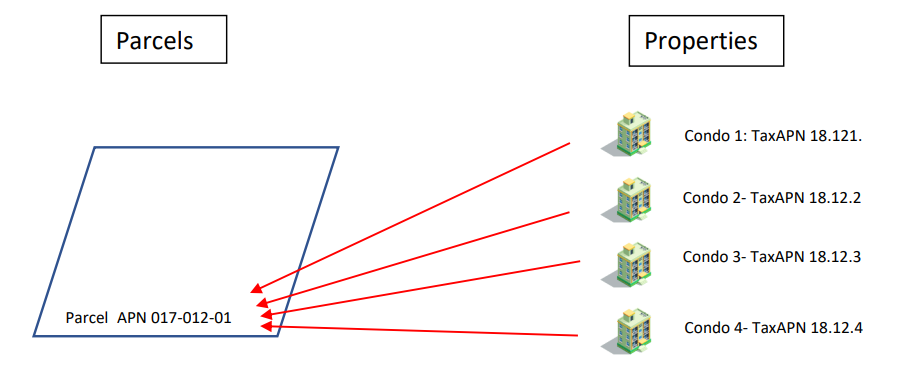

A: Stacked parcels occur when multiple properties share the same physical area, such as condominiums, timeshares, mobile homes, or strip malls. In these cases, multiple taxable properties are associated with a single parcel definition. They do not have a unique or separate geometry. They all share a single common geometry.

(Multiple taxable properties on one parcel)

Therefore, when tax assessment records are joined to the geometry, the end result is a stack of duplicate geometries with different records attached.

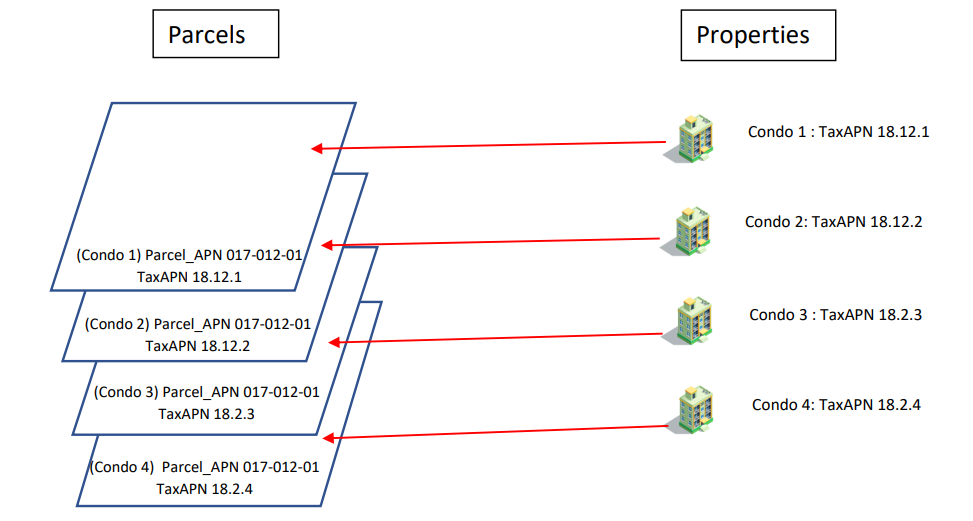

(Parcels with duplicate IDs attached to each unique tax ID)

LightBox processing selects the common geometry and identifies this as the “master” parcel, tax assessments that share this are then associated to the same master parcel. The parcel layer SmartFabric provides only contains the “master” parcel, therefore will not contain duplicate parcel geometries. However, if parcels are joined to the assessment layer, it will result in duplicate or “stacked” parcels due to some properties not having their own geometries as mentioned above.

Q: How does one parcel have multiple assessments?

A: A good example of this is a condominium complex where there are multiple taxable properties on a single parcel master parcel. This also occurs with mobile home parks, timeshares, some commercial properties, and new ownership models, to name a few.

See Parcel vs Assessment Relationship for additional information.

Q: In my data delivery, what are the fields AGGR_ refer to?

A: These fields represent common ownership as defined by LightBox. We look at adjacent parcels within 300 feet and if the property is owned by the same owner we aggregate "AGGR_" the information.

- AGGR_ACREAGE - The aggregate of the acreage

- AGGR_GROUP - Is an ID that is used to identify the parcels associated with the group (same ownership within 300 feet)

- AGGR_LOT_WIDTH_MEDIAN - The aggregate lot width median

- AGGR_LOT_COUNT -The count of parcels with the same owner within 300 feet that make up the aggregation.

Q: Is AGGR_ or common ownership represented in the API?

A: Absolutely, there is an endpoint on the Parcel API called adjacent. It will pull all the adjacent parcels or only the adjacent parcels with common ownership.

.png)

.png)